By Brent Davis, Senior Director of Accounts, Becker Media

Cord cutting, the phenomenon of consumers canceling their paid cable and satellite TV subscriptions, is certainly not new. Research shows that cord cutting is accelerating rapidly in recent months. According to a recent eMarketer forecast, roughly 20 million additional people will have canceled their cable and satellite subscriptions by 2021. That’s an average of more than 5 million people per year for the next three years. That doesn’t even account for the millions who have already cut the cord on paid TV in the past decade.

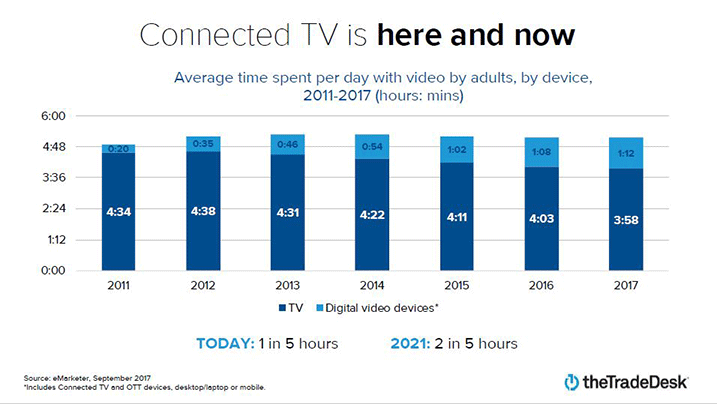

Average time spent viewing traditional TV is down as well, unsurprisingly. Another eMarketer study found that over four and a half hours were spent watching linear TV per day in 2012. By 2017, that number was reduced by 40 minutes per day to three hours and 58 minutes, a decrease of nearly 15 percent. While schools can still reach students on traditional, linear TV, it’s becoming more important to diversify their TV strategy. Time spent watching Connected TV (smart televisions connected to the internet) and OTT (over-the-top streaming – on devices such as phone, laptops, and tablets) has more than tripled since 2011, to over one hour per day. By 2021, they project that number will reach two hours per day.

There is no reason to believe the linear TV industry will ever be the same, or that these trends will reverse at any point, so schools need to adapt if they’re not doing so already. The television landscape has already irrevocably changed, and schools are already being forced to adapt to a new world where media consumption grows more fragmented every year.

Although the cable and satellite companies continue to bleed subscribers at a rapid pace, this doesn’t mean students are consuming less video content. The rise of Netflix, Hulu, SlingTV, Roku, and almost countless other streaming TV services are changing the landscape of television. Younger generations may be cutting the cord on their pricey cable subscriptions, but the leaner packages offered by their streaming competitors allow individuals more control and flexibility over what and when they watch.

eMarketer says that of those who watch more than three hours of video per day; millennials are more likely to want to stream content online than other generations. All other generations, on the other hand, are more likely to want to watch live on cable and satellite TV. Another study by Pew Research Center in 2017 showed that 61 percent of those aged 18-29 are watching TV via an online streaming service. Although definitions on generation Z and millennials can differ, there is no doubting that younger generations are growing up in a streaming-first world.

With this change comes anxiety for advertisers and educators who have depended on TV for inquiry generation for decades. While the number of cable networks ballooned over the 21st century, advertisers still had a straightforward entry point to reach their audience. Between broadcast and cable TV, one could reach the vast majority of their potential audience through a handful of sales representatives and insertion orders.

Today, it’s almost impossible to keep up with the number of ways one can consume content in the digital age. While some services like Hulu have gained significant notoriety and share of the market, there is little to no loyalty to one specific app or service when it comes to video consumption. A student might watch their favorite streaming show on Hulu, then 30 minutes later switch to a streaming sports app to watch a live basketball game. After all that, they might flip to a different app to catch up on news in their local area.

A blend of free and pay services generally allow consumers to mix and match providers to fill any gaps created by cord cutting – at a significantly reduced price point.

Devices add another element of change and fragmentation to the market as well. All those different forms of content can be viewed anytime and anyplace. Gone are the days where the entire family would congregate in the same room on the couch in front of the big screen TV. Not only can that big screen TV now stream content on-demand, but other individuals in the room might be loading entirely different shows on their tablets at the same time.

So, while content options continue to explode, and audience fragmentation reaches new heights, it is understandable that advertisers are overwhelmed or frustrated. There are; however, ways to still efficiently reach a target audience in the Connected TV (CTV) world. Using the right tools and strategies, there are reasons to believe CTV will be more effective than its linear TV counterpart.

One of the biggest reasons for optimism about CTV is the ability to target at a level not previously available to TV advertisers. Broadcast TV (the major networks like ABC, CBS, NBC, etc.) targeting still relies on a designated marketing area (DMA) level placement of ads. Placing a buy in a major metro area like New York or Chicago means serving your message up to the millions in the DMA, with no alternative to slim down the audience. Cable TV upped the ante by allowing “zone” based scheduling, in which cable providers offered pre-set zones made up of multiple ZIP codes within one DMA to fine-tune targeting. Instead of targeting an entire DMA, this gave advertisers the ability to carve out sections of the DMA that made geographic sense.

While cable zones allowed for some flexibility, the ZIP codes in each zone are still pre-determined by cable providers, and often include extraneous coverage for some advertisers. Additionally, cost-per-thousand ad impressions (CPMs) are generally less efficient on cable zoned schedules as opposed to buying an entire DMA. In other words, a premium in price was placed on narrowing your reach.

The other advantage of cable TV was that fragmented networks allowed targeting of more niche audiences. With more programming choices, advertisers could try and select specific networks that they believed would align with their audience’s interests. This, however, was still mostly based on age and gender demographic information coupled with educated guesses of which networks appealed to your students.

This is where CTV has a distinct advantage over linear TV.

There is no longer the need to place a schedule by buying specific shows, or programming. The tremendous advantage lies in making placements simply towards a specific audience – regardless of what programming they are watching. By partnering with a demand-side-platform (DSP), an advertiser can integrate first, second, or third-party data to directly target the exact audience they are looking for.

DSPs also provide another solution to a major CTV issue stated above – audience fragmentation. With so many streaming services available to the public, how does one tap into all of these different providers that are supplying content? With new providers popping up (and dying off) regularly, it would be nearly impossible to keep track of the playing field. This is where programmatic buying comes in.

Programmatic buying allows advertisers to bid for media inventory from many sellers at once on a single platform. It greatly reduces the strain on the buyers so that they do not need to manage large volumes of insertion orders, or worry about picking the right websites, applications, or content. The user can interact with the DSP to choose all of the characteristics of their audience, set a bid on what they are willing to pay by impressions, and then let the machines do their work to go out and serve ads to their target market at the buyer’s set price and budget.

DSPs are not exactly new, and advertisers have had the ability to utilize the significant targeting advantages via digital display campaigns for years. The demand on CTV however, is accelerating at an extremely rapid pace. According to the independent video supply side company, Beachfront, ad requests on CTV rose 1,640 percent from November 2017 to November 2018. That’s an increase from 1.7 billion ad requests to 29.9 billion year-over-year.

It’s reasonable to believe CTV advertising growth will continue to be rapid in the months and years to come. CTV marries the highly specific targeting and campaign control with the power of big screen TV. In 2016, a Nielsen-backed study by the Council for Research Excellence showed that ad recall on big screen TVs significantly outpaced other devices. In the study, individuals recalled 62 percent of advertisers they saw on a TV, compared to 47 percent, 46 percent, and 45 percent for tablets, phones, and laptops respectively.

Campaign performance tracking is another area that continues to improve and provide new advantages over linear TV. CPM and frequency-based metrics will always be useful to measure efficiency, but advancements in IP matching allows advertisers to be able to track household user engagement after an ad is viewed. Proper pixel placement can provide data to show if a user visits a specific website or landing page from another device in the same household after viewing an ad.

The real value in this tracking is how it allows for campaign optimization and improvements.

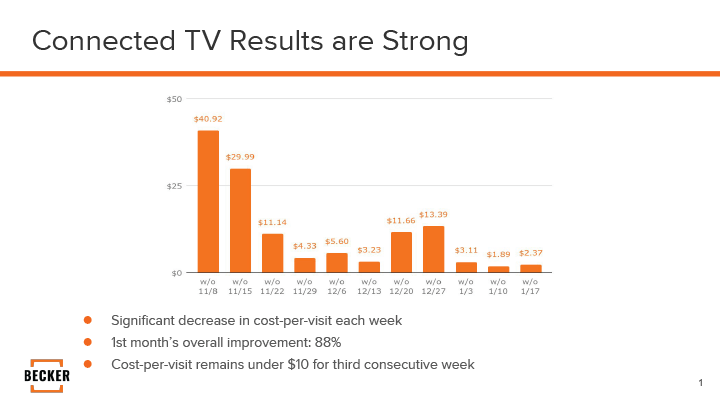

For example, a recent client campaign launched with the goal of driving viewers to the school’s main organic website. Since this was a CTV campaign, there is no link clicking, so all site visitors are high quality traffic individuals who sought out the school directly by entering the URL or searching the client’s brand on a device in the same house that they saw the CTV ad in.

The campaign was built by targeting specific ZIP codes around the school’s campus. Age, gender, education level, income level, and specific interest group targeting were all added to the audience build. In week one, the campaign delivered a cost of $41 per visitor. After examining the data to see which dimensions in the schedule were driving the most visitors, optimizations were made that cause the cost to drop below $5 by week four. At week 10, the cost per website visit was below $2.

The same logic can be applied to a thank-you page for a form submission. Under these circumstances, one could view an ad on their Connected TV, perform a search on their phone, end up on a website, and fill out an inquiry form, with all of this information tracked by a DSP. Optimizing a CTV buy can ultimately be done by determining what is driving inquiries by demo, time, location, creative, and more.

As most schools learned over the years, TV wields considerable power over generating inquiries and creating brand awareness. While declining viewership has hit the traditional TV market in recent years, one might have believed that we were witnessing the beginning of the end of TV’s influence. But as is always the case, things have changed with technology. The number of eyeballs watching traditional television will most likely continue to fall, but the power of CTV, or streaming TV, will likely eclipse the effectiveness of traditional TV because of its incredible ability to micro-target audiences at an unprecedented efficient cost.

References:

1. Cord Cutting Is Accelerating Rapidly, Research Firm Says http://fortune.com/2018/07/24/cord-cutting-comcast-netflix/

2. The Digital Video Series: Millenials – Infographic

https://www.emarketer.com/content/the-digital-video-series-millennials-infographic

3. New Research Study Finds That TV Outperforms Digital Platforms in Viewer Ad Attention and Recall

https://www.businesswire.com/news/home/20160629005147/en/New-Research-Study-Finds-TV-Outperforms-Digital

4. The Trade Desk via eMarketer September 2017 (TimeSpentWatching)

5. Beachfront Releases 2018 CTV Ad Data, Roku Still Leads, Amazon Growing Quickly

https://www.broadcastingcable.com/post-type-the-wire/beachfront-releases-2018-ctv-ad-data

BRENT DAVIS has worked in the education market all of his professional career. Davis started with Becker Media after graduating from the University of Delaware in 2006. After the long trek across the country, he began an entry-level job with Becker Media, in Oakland, CA. Since then, he has worked in every facet of the agency business; from traditional media buying, to account service, to digital media management. Davis has gained extensive experience that he has leveraged into a strategic role. After a move to Baltimore in 2011, he opened and continues to manage the East Coast operations in Federal Hill, Baltimore. His passions are problem-solving and spending time with his wife and two young boys.

Contact Information: Brent Davis // Senior Director, Accounts // Becker Media // 510-465-6200 x 107 // bdavis@beckermedia.net // www.beckermedia.net // https://www.facebook.com/BeckerSocial/