Press Release

For the past twenty plus years the U.S. Department of Education (Department or ED) has knowingly and willfully led a full-scale assault against free enterprise in higher education. Using choreographed data manipulation and misreporting, misrepresentation of the impact of the data, and heavy-handed enforcement tactics designed to ensure that their manufactured story took hold and has continued to be perpetuated, the Department’s efforts to deceive have been highly effective—until now.

A recent 312-page investigative report, Injustice for All, authored by the leading expert on default prevention Mary Lyn Hammer, hopes to expose what she believes is a two-pronged approach to eliminate for-profit entities participation in higher education.

Injustice for All first details how the Department, and key allies in Congress and the Obama White House, sought to, and eventually did in February of 2009, sway public opinion away from a competition between free enterprise and government-operated student loan programs, leading to the establishment of the Federal Direct Student Loan program and the federal government as the sole administrator of federal student financial aid delivery and collections.

While the most direct consequence of this pursuit was the elimination of the rival Federal Family Education Loan program, the most devastating impact was not on the free enterprise entity eliminated. Ironically, the most devastating impact has been on the over 400,000 students who have wrongfully been designated as borrowers in default as a result of the Department’s poor administration of the transition to 100% direct lending for student loans.

More recently, Injustice for All chronicles similar efforts to eliminate the private, proprietary sector of higher education. Again, the report details how the Department used misreporting and extreme regulatory measures in an effort to bring down a portion of the higher education community that caters to the underserved population of at-risk students—Americans who are trying to use education to stop being dependent on the entitlement programs that they have grown up in and become a part of the educated and working middle class.

While there are schools in every sector of higher education that should be under review and increased scrutiny, there are many high quality private, proprietary institutions. Injustice for All questions why the Department is myopically focused upon only one sector of higher education and has organized additional efforts to influence public opinion to the detriment of free enterprise.

Ms. Hammer’s report concludes that the Department has used its authority to falsely report information about sectors-level performance with a focus on influencing the public into believing that all proprietary schools are predatory and all public or non-profit schools are good—this is far from the truth found in the Department’s own databases. To summarize, the Department’s press releases and reporting do not match its own databases.

Congressional Committee Members and staff for the U.S. House of Representatives’ Committee on Education and the Workforce, Committee on Oversight and Government Reform, and the U.S. Senate Committee on Health, Education, Labor and Pensions have begun to take notice of the facts documented in Injustice for All, audited by an independent accounting firm, and turned over as evidence. Leaders for these committees have conducted their own investigations of the evidence, and have begun the process of questioning the Department.

Leaders on the education committee are considering legislation to rectify the default status of several hundred thousand student loan borrowers that will also correct cohort default rates for the institutions the students attended. Ms. Hammer feels strongly that this will score a federal fiscal savings because the cost of servicing defaulted loans is more expensive than for those in repayment; there are many borrowers who have multiple servicers where multiple fees are being paid (repayment fees and default fees); and by repairing the credit record and freeing up spending money for hundreds of thousands of Americans, our economy will be stimulated.

Some of independently-verified evidence documented in this investigative report, Injustice for All, includes:

FACT #1

Ironically, the very same Department who has been on a campaign to “save” students from “predatory schools”, did not stand up for the students by including solutions for these student loan victims during its recent negotiated rulemaking for borrower defenses that concluded without consensus last month.

Ms. Hammer is seeking legislative relief to reverse the default status for an estimated 403,000 of these student borrowers, correct their credit history, and allow them a chance to repay their loans with appropriate quality servicing. Additionally, the government should reverse the defaults and correct related default rates for all affected institutions because state and federal grant and loan funds for currently enrolled students are also affected by these defaults that never should have occurred and have nothing to do with institutional quality.

NOTE: The Department miscalculated numerous cohort default rates in its Official National Briefings. We have provided the published rate and the correct calculation.

FACT #2

The Department misreported loan program performance by either reporting its own default rates lower than data shows and the private-sector FFELP default rates higher than data shows, or by not reporting direct loan default rate information at all. Is this is an attempt to cover up the Department’s own poor performance and /or mismanagement of the student loans?

For the FY 2009 3-year loan program cohort default rates released in September 2012, approximately 130,000 defaulted borrowers were reported under the FFELP default rate when they actually belonged to the FDSLP default rate–there was only 440 borrowers’ difference. Is it just a coincidence that the totals for the briefings and the loan program data were virtually the same?

Similar patterns of misreporting and underreporting have been documented for loan program CDRs for FY 2010–FY 2012. The truth is that even with diminishing returns, the FFEL Program is performing much better than the FDSLP and portfolios managed by the Department.

NOTE: The Department miscalculated numerous cohort default rates in its Official National Briefings. We have provided the published rate and the correct calculation.

FACT #3

The public has been consistently told that eliminating the FFEL Program would save taxpayers money. The truth is that in 2010 prior to passing SAFRA, the same legislation that brought us Obamacare, the Congressional Budget Office (CBO) published “2010 CBO Report: Costs and Policy Options For Federal Student Loan Programs” that stated the elimination of the FFEL Program would “…increase the deficit by $52 billion on a fair-value basis… “ and “…The savings from implementing the President’s proposal to replace FFEL loans with direct loans decline from a total of $62 billion over the 2010–2020 period under FCRA accounting to $40 billion on a fair-value basis.” The total deficit from this decision was projected at $74 billion and Obama knew these numbers every time he claimed this decision as a savings from 2010 to date.

FACT #4

An executive order defined the “Pay As You Earn” repayment program (PAYE) as follows:

- Drops student loan payments to 10% of discretionary earnings,

- Increases the repayment period from 10 to 20–25 years,

- Forgives the remaining debt at 20–25 years with a 1099 for the total amount forgiven AND a related “lump sum” tax liability to those who could not pay.

In 2015, the Department released regulations that increased the availability of this repayment option to additional student loan borrowers (REPAYE). In essence, these programs put low- to middle-income student loan borrowers in a negative amortization and they owe more in 20–25 years than they do when they leave school. This also makes most or all of the student loan payments interest—profit to the government. For 2013, the government’s profit on student loans added up to $41.3 billion dollars. The profit since then has not been publicly released.

FACT #5

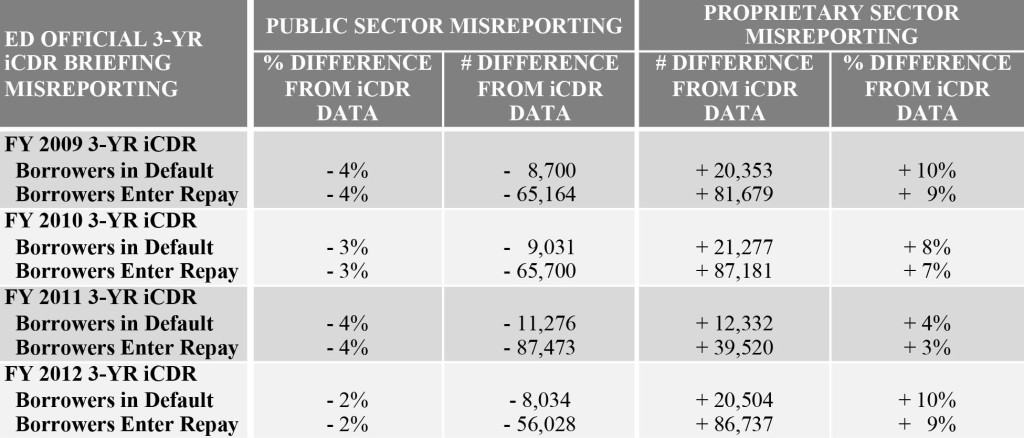

For the last four years of institution cohort default rates (iCDR) analyzed, the Department’s “national official” briefings have not matched the institutional iCDR data that is publicly available on the Department’s website. Patterns have consistently favored public schools while hurting the proprietary sector. If the proprietary sector was as bad as the Department wants everyone to believe, why is there a need to misreport numbers in the “Official National Briefings” for iCDRs that make the sector look worse than it actually is? The FY 2012 data reality shows the public sector actually had 91,553 MORE defaults than the proprietary sector—but that’s not what the Department wanted the public to see. When the iCDR data is used, the proprietary sector default rate is 15.4%, not the 15.8% that the Department published in its press release (ED Department Official 3-year iCDR Briefing.)

FACT #6

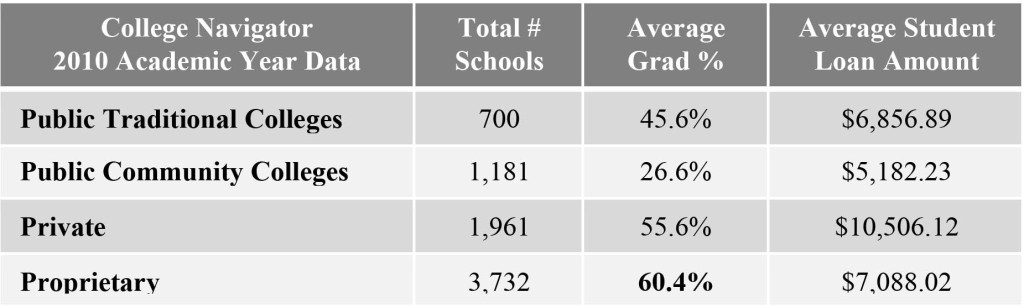

The College Navigator hosted by the Department provides extensive information about schools. The 2010 academic year data available at the time Ms. Hammer completed her analysis shows that the proprietary sector has the highest graduation rate among all sectors. The average federal student loan amount for proprietary schools, based on their actual funding levels, show that the loan balance is reasonable especially considering a 60.4% graduation rate. When compared to community colleges serving a similar socio-economic student group, the proprietary loan amount is comparatively lower considering that the sector graduates more than twice as many students as community colleges. These graduation rates are consistent with recently released statistics from the National Student Clearinghouse for graduation rates for two-year public of 38.14%, private of 45.07% and proprietary of 60.62%.

FACT #7

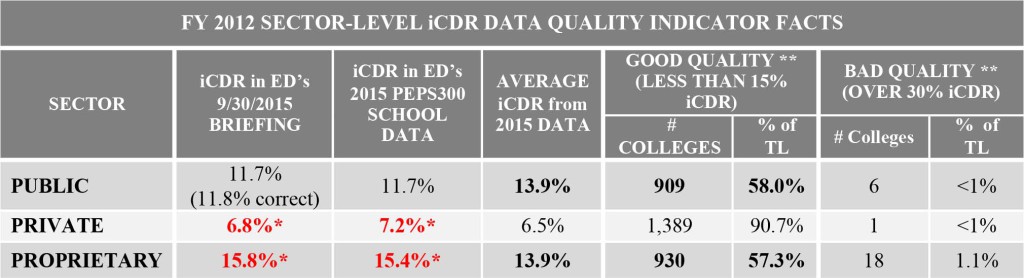

The FACTS about the quality of public and proprietary sector performance based on institutional cohort default rate (iCDR) data (2015 PEPS300 data file) show that the public and proprietary sectors have almost identical statistics for good quality indicators. When the default rates are averaged, giving each institution equal consideration, the public and proprietary sectors have the exact same average iCDR of 13.9%.

* The Department misreported FY 2012 iCDR rates for the private and proprietary sectors. ** Includes schools with 30 or more borrowers in the iCDR.

FACT #8

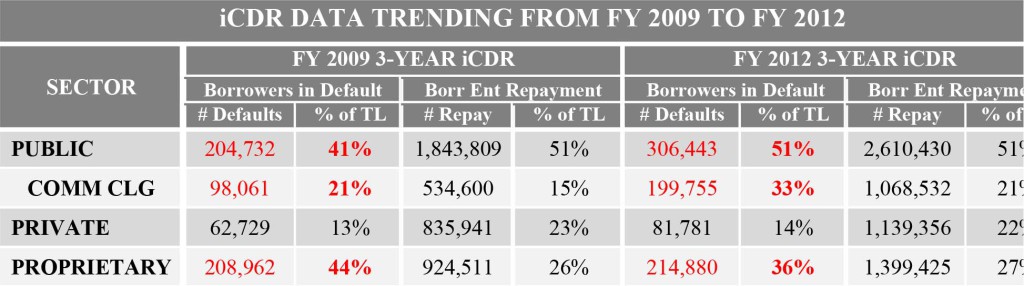

The iCDR trends over the last four years show that the public institutions have rapidly escalating numbers of students in default while the proprietary sector has shown a significant reduction in its percent of total defaults.

FACT #9

AND THERE’S MORE… Extensive evidence is documented in Injustice for All and available at http://www.marylynhammer.com/about-injustice-for-all. This mountain of errors in reporting cannot be coincidental. Is the inaccurate reporting across many federal higher education databases being used to assault and defame proprietary schools actually a deflection from ED’s own poor performance? Ms. Hammer has led a passionate fight to represent at-risk students and the institutions that serve them for nearly 30 years. She states, “Education is one of many freedoms that are being taken away from Americans. We now have a monopoly on student loans where the Department self-assesses its performance, there is an egregious lack of oversight, and there is no competition to drive quality standards and performance. We also have a system where unlawful and unrealistic standards are applied only to for-profit institutions while substandard performance is ignored in other sectors of higher education. Our children deserve better than that—they deserve to have consistent quality standards that apply to all institutions so that they are truly educated when they graduate from college. As for those students who are in default when they shouldn’t be—I find it abhorrent that these students have suffered severe consequences of default when the Department knew that this happened and chose to no nothing to correct it. As a nation, it is time to stand up and demand quality education and oversight of those government offices that determine the future of our children and our country.”

About Mary Lyn Hammer

Ms. Mary Lyn Hammer is a seasoned education advocate, and the entrepreneurial founder, president and CEO of Champion College Services. Her belief that education is the vehicle for making dreams come true has led her into a life-long passionate fight, beginning in 1987, rectifying problems in the higher education industry to insure future participation for all students. During her career in higher education, she has touched more than 3 million students’ lives through her companies and advocacy. Ms. Hammer’s company Champion College Services (now it its 26th year of business) offers default prevention for federal and private student loans, job placement verification, skip tracing, consulting services, and custom surveys for students, alumni, and employers.

Ms. Mary Lyn Hammer is a seasoned education advocate, and the entrepreneurial founder, president and CEO of Champion College Services. Her belief that education is the vehicle for making dreams come true has led her into a life-long passionate fight, beginning in 1987, rectifying problems in the higher education industry to insure future participation for all students. During her career in higher education, she has touched more than 3 million students’ lives through her companies and advocacy. Ms. Hammer’s company Champion College Services (now it its 26th year of business) offers default prevention for federal and private student loans, job placement verification, skip tracing, consulting services, and custom surveys for students, alumni, and employers.

Her accomplishments include numerous state, regional, and national awards and recognitions over the years in both the higher education industry and in professional business arenas. She has participated in training sessions and workshops for numerous state, provincial, regional, national, and private associations in both the U.S. and Canada in a continued effort to share her experiences and knowledge. Ms. Hammer has had several hundred articles published in numerous higher education magazines.

Her experience specific to the contents of this book include the following:

1988–1989 Hammer turned evidence over to Congress and the U.S. Department of Education (USDOE) and testified numerous times regarding a student lending corruption ring in California that put several companies out of business and cost the government an estimated $750 million to rectify.

1989 Her innovative “Hands On” Default Management Program was recognized by the USDOE for its remarkable results and was used as the basis for default management in what became known as “Appendix D.” Ms. Hammer was active in aiding the USDOE in drafting regulatory language for default management that was mandatory for high default rate schools from 1989 until 1996 and still exists today in rewritten regulations under “Subpart M” and “Subpart N.”

1990–1993 As part of several laws affecting higher education and cohort default rates, Ms. Hammer helped draft statutory and regulatory language for cohort default rate appeals.

1993–1995 Hammer helped draft the Cohort Default Rate Guide and several revisions thereof.

1994–1998 Hammer worked with Congressional members on school-based loan issues and cohort default rate matters that became statutory language in the 1998 reauthorization of the Higher Education Act of 1965.

1999 She served as an alternate negotiator for school-based loan issues in the 1999 Negotiated Rulemaking.

2000 She served as a primary negotiator for school-based loan issues in the 2000 Negotiated Rulemaking. The original default management regulations under “Appendix D” were rewritten into “Subpart M” in addition to other loan issues.

2002–2008 Hammer worked with Congressional members on school-based loan issues and cohort default rate matters. Although she was opposed to increasing the cohort default rate definition, she was instrumental in correcting what was originally written as a 4-year CDR definition to a 3-year CDR definition and helped draft the increased threshold and appeal rights for sanctions under the new definition.

2009 She served as a primary negotiator for Loan Issues—Team 2 and provided expert witness testimony for Team 1 Loan Issues. Default management regulations were written into “Subpart N” for the 3-year CDR definition along with conforming language for appeals in addition to other loan issues.

1988–2014 Hammer has testified many times at Congressional and USDOE hearings and has worked closely with Congressional members, education committee professional staff, and key staff at the USDOE on many issues during her career to insure program integrity and access to quality higher education for at-risk students.

Ms. Hammer has been elected four times to the Board of Directors for the Career College Association, now known as APSCU, and she is the Charter Member, former Chairwoman for the Higher Education Allied Health Leaders (HEAL) Coalition, and has served as an Advisory Board Member for the Career Education Review. Additionally, she currently serves on the Board of Directors for the Private Career Colleges and Schools (PCCS, 3rd term) Regions XIII, IX & X and for the Northwest Career College Federation (NWCCF, 16th term), as Director of the Board for Champion for Success (a nonprofit mentoring and advocacy for at-risk kids), and on the Board of Directors for eMed, a medical research center for Chinese medicine.

Injustice for All, is written to provide us with detailed evidence on corruption in education reporting to protect the future of our country.

For More Visit MaryLynHammer.com

CONTACT

Email: info@MaryLynHammer.com

Contact: John White

Office: 480.222.4314

Mobile: 480.433.2392

Injustice for All: The Truth about the Annihilation of American Education Ideals

312-Report by Mary Lyn Hammer

Independent Accountants Reports Verification Conducted by Kaiser and Carolin, P.C.

Publisher: Champion Empowerment Institute

Box 97001, 3920 E Thomas Rd, Phoenix, AZ 85018

ISBN: 978-0-9970978-0-1 (paperback)

ISBN: 978-0-9970978-1-8 (ebook)