Does Your Institution “Act CAREfully” When it Comes to Accounting, Recording Keeping and Documentation of Federal Funds?

By Michael T. Wherry, CPA, and Dave McClintock, CPA, McClintock & Associates

The American political satirist P.J. O’Rourke once opined, “giving government power and money is like giving a 16-year old keys to the car and a bottle of scotch.” Well said, as this creates a situation fraught with peril.

Postsecondary institutions must be feeling the same way, as they are potentially receiving significant amounts of funds from either the Small Business Association’s (SBA) Paycheck Protection Program (PPP) loans and/or the CARES Act’s Higher Education Emergency Relief Fund (HEERF), all with limited specific guidance received from the applicable regulatory agencies. Normally, institutions receive Title IV funding after a rigorous application process and are awarded funds under very specific and extensive regulatory guidelines.

Amid the COVID-19 pandemic, however, funds are essentially being thrown at institutions with the general idea of “we’ll figure it out later.”

We don’t state this to be critical of Congress or the regulatory bodies providing oversight. They are working to keep, arguably, the world’s most important economy from collapsing, and getting funding to institutions, as well as their students and employees, as fast as possible is part of lawmakers’ stabilization plan. We recall O’Rourke’s comments merely to identify the unique circumstances and the potential risk this has created for institutions which haven’t thoroughly vetted their policies and procedures for accepting, documenting, accounting and reporting the use of these funds. This article will review best practices related to the PPP loans and HEERF.

HEERF basics

Let’s start with the HEERF grants allocated to institutions by the U.S. Department of Education (ED). Institutions are receiving funding of which at least 50% must be utilized for emergency student grants. The HEERF funding is not two separate independent funding sources. Instead, it is one source of funding broken into two tranches. This is critical, as at least 50% of the entire funding amount must be spent on the emergency grants for students. Therefore, the institutional portion expended can’t, under any circumstances, exceed the student portion expended.

Since institutions will have to report the use of these funds to ED, and the scrutiny of these funds is unknown, we recommend that institutions set up new and separate bank accounts for the student and institutional portions. The HEERF has been allocated by ED based upon main OPE ID numbers. Thus, for institutions which have multiple main OPE ID numbers, we recommend two new HEERF bank accounts for each main OPE ID number. Commingling the funds into one new HEERF bank account or the current operating bank account is not recommended, as institutions should have a clear trail of the propriety of the funds. The Funding Certification and Agreement, which was signed in order to receive the student portion of the HEERF, specifically indicates that the “recipient holds those funds in trust for students and acts in the nature of a fiduciary with respect thereto…”

The commingling of these funds, especially in the institution’s operating bank account, can lead to questions related to the trusteeship of the funds.

ED didn’t specifically mention any cash management regulations, but the Funding Certification and Agreement indicates compliance with 2 CFR part 200, as adopted and amended as regulations of the Department in 2 CFR part 3474. Under 200.305(b), non-federal entities are required to maintain federal funds in interest bearing accounts, unless the following exceptions are met: (1) the recipient receives less than $120,000 in Federal awards per year, (2) the best reasonably available interest-bearing account would not be expected to earn interest in excess of $500 per year on federal cash balances, or (3) the depository would require an average or minimum balance so high that it would not be feasible within the expected federal and non-federal cash resources. In addition, the federal regulations indicate that a grantee is required to minimize the amount of time between the drawdown and the expenditure of funds from their bank accounts. Because we are recommending that the funds be drawn down from G5 only as they are expended it is unlikely an institution would earn more than $500 in interest income due to the limited time these funds are being maintained. Nevertheless, each institution should review the implication of this regulation for their specific circumstances.

The information discussed above is relevant for the student and institution HEERF amounts. However, the accounting and recording keeping will have some similarities and differences. The underlying accounting for the student emergency grants is relatively straightforward. We recommend that new accounts are setup in the general ledger system which will only track these funds. This will provide a clear trail and assist in any reporting the institution is required to perform. The basic accounting entries are as follows:

HEERF Student Portion – Funds Received

Debit – HEERF student bank account

Credit – HEERF student liability account or HEERF deferred revenue account

HEERF Student Portion – Funds Expended

Debit – HEERF student liability account or HEERF deferred revenue account

Credit – Cash operating bank account/student stipend bank account

Debit – Cash operating bank account/student stipend bank account

Credit – HEERF student bank account

(These entries assume the actual disbursements are being processed from the institution’s operating or student stipend bank account).

McClintock & Associates is researching if these funds need to be recognized on the income statement as revenue and student expenses under Financial Accounting Standards Board (FASB) ASU 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made (ASC Topic 958). This ASU applies to nonprofit entities and appears to be applicable to business entities, as well, which would cover for-profit institutions. The revenue and the student expense recognized would offset, so no impact on net income would occur. In addition, we are researching as to whether a receivable should be set up when the HEERF funding is received, prior to any draw down from the G5 system. Currently, we don’t believe a receivable would exist, because the institution hasn’t earned the grant funding until the funds are disbursed to students, as restrictions exist on this funding (i.e., student eligibility, students enrolled at the time of the emergency declaration, etc.).

Originally, per the Funding Certification and Agreement, institutions had to report the following information to ED within 30 days of signing the agreement and every 45 days thereafter: how the grants were distributed to students, the amount of each grant awarded to each student, how the amount of each grant was calculated, and any instructions or directions given to students. ED has not published instruction in the Federal Register information related to the required reporting to ED. However, in the interim, on May 6, 2020, ED released an announcement requiring information to be reported on an institution’s website 30 days after it receives its student portion funding allocation and updated every 45 days thereafter. The information to be posted is related to the total amount of funds the institution will receive or has received pursuant to the agreement, the total amount of funds distributed to students, the estimated number of students eligible to receive the funding (Title IV eligible students), the total number of student who have received the funding, the methods used by the institution to determine which students receive the funding and how much they would receive, and any instructions provided to students on the use of the funds.

Thus, institutions need to ensure documentation exists for proper recording keeping.

We recommend that a spreadsheet is developed (whether manual or generated from the institution’s student information system) to capture all applicable student information each time student disbursements are made. This spreadsheet should include a reconciliation which includes the total allocation received, less the amount in G5 which is not draw down or which is still in the HEERF student bank account, and compares this number to the cumulative emergency student disbursements made. If these numbers do not agree, the institution should review the spreadsheet to ensure it is complete and accurate. We encourage institutions to seek guidance from the auditor, Title IV servicer, or we are available to assist in developing a potential spreadsheet as we await more specific guidance from ED. In addition, institutions should review their policies and procedures used to award the emergency student funds and the instructions/applications provided to students. Since this information will need to be posted on the institution’s website, we recommend that regulatory counsel review this information.

Institutions have inquired if these funds can be posted to the student’s ledger card in their student information system to assist in the tracking, record keeping, and reporting process. As a brief reminder, the student portion cannot be used for the following items:

- Resolving outstanding student balances owed to the institution,

- Establishing scholarships,

- Reimbursing the institution for technology hardware provided to students, or

- Reimbursing the institution for any refunds made to students for tuition, room and board, or any other fees.

The guidance ED published on April 9, 2020, specifically addressed these items. However, ED wasn’t implying that the student ledger system couldn’t be used to track the funds. Institutions need to be extremely careful that if these funds are posted to the student ledger cards that they aren’t applied to any outstanding balance, aren’t treated as institutional charges, and don’t alter any Title IV credit balance calculations, R2T4 calculations or 90/10 calculations. The posting of this funding has to “wash” on students’ ledger cards. One recommendation we have is to perform a check to ensure the total student accounts receivable balance is the same number before and after the emergency student grants are disbursed. In addition, steps should be added to the R2T4 calculation process to verify the institutional charges are being correctly computed. The 90/10 calculation should be reviewed to verify that this emergency funding is not being included in institutional charges or as a funding source. Finally, it seems likely that these grants will need to be reported on students’ IRS Form 1098-T, as the grants reduce the qualified expenses paid by the students. However, we are awaiting official IRS guidance on this item.

HEERF institutional grants

Similar to the student portion, the underlying accounting for the institutional HEERF amounts is not complex. The basic accounting entries are as follows:

HEERF Institutional Portion – Funds Received

Debit – HEERF institutional bank account

Credit – HEERF institutional liability account or HEERF deferred revenue account

HEERF Institutional Portion – Funds Expended

Debit – Applicable expense or fixed asset

Credit – Cash operating bank account

HEERF Institutional Portion – Funds Reimbursed to Institution

Debit – HEERF student liability account or HEERF deferred revenue account

Credit – Grant revenue or netted against the expense

(If the related expenditure is a fixed asset and has a life in excess of one year, the grant revenue may need to be recognized over the same life as the asset. As noted for the student HEEERF amounts, we are researching the recognition of the grant revenue and expenses).

Debit – Cash operating bank account

Credit – HEERF institutional bank account

As a reminder, the institutional HEERF amount can also be used to provide more emergency grants to students, and institutions should follow the guidance already provided if they are doing so.

Similar to the student HEERF amount, we are researching as to whether a receivable should be set up when the HEERF funding is received, prior to any draw down from the G5 system. Currently, we don’t believe a receivable would exist, as the institution hasn’t earned the grant funding until the funds are utilized. Due to the limited guidance existing at the moment, uncertainty exists as to the extent of the funds an institution may utilize. Therefore, until an eligible expense is incurred, we don’t believe a receivable exists.

Per the Funding Certification and Agreement, institutions will need to report the use of the institutional HEERF amounts. The Questions & Answers released by ED on April 21, 2020, indicated in #9, “As explained in the Funding Certification and Agreement for the Institutional Portion of the Higher Education Emergency Relief Fund, the institution should be prepared to report the use of the funds for Recipient’s Institutional Costs, demonstrating such use was in accordance with Section 18004(c), accounting for the amount of reimbursements to the Recipient for costs related to refunds made to students for housing, food, or other services that Recipient could no longer provide, and describing any internal controls Recipient has in place to ensure that funds were used for allowable purposes and in accordance with cash management principles. The Department will publish a notice in the Federal Register to provide instructions to institutions on these reporting requirements. The Department encourages institutions to keep detailed records of how they are expending all funds received under the HEERF.”

As a result, institutions need to maintain documentation of the expenditures for which the institutional HEERF is utilized.

For example, this would include, as applicable and not limited to, a purchase order, invoice, approvals, check copy or ACH, purpose of the expenditure, and basis for concluding how this expenditure had a clear nexus to significant changes to the delivery of instruction due to the coronavirus. In addition, institutions should ensure that an explanation of the internal controls and processes related to purchasing and disbursements is well documented, as ED mentions the describing of internal controls which are in place. We would recommend that a one-page document is developed to support each expenditure covered by the institutional HEERF. This document would include the explanation and basis for the conclusion, and institutions should ensure that existing policies for multiple signatures in regard to fixed asset acquisitions or significant purchases are followed. In addition, this document can be attached to a copy of the supporting purchase details (items noted above), so a separate file can be maintained solely for the institutional HEERF amount. As we await more clarification from ED as to the type of costs which meet the definition of significant changes to the delivery of instruction due to the coronavirus, the following items are specifically disallowed:

- The reduction of student accounts receivable balance, student institutional loan balances, or the payoff of student, private loan debt,

- Payments to contractors for providing pre-enrollment recruitment including marketing and advertising,

- Endowment contributions,

- Executive compensation, or

- Stock buyback and shareholder distributions.

PPP loans

In addition to the HEERF grants, some institutions also received a PPP loan that could be partially or fully forgiven. This funding was rolled out at an unprecedented pace — with some unanticipated results.

PPP allows eligible small businesses to apply for SBA loans, which will be forgiven if spent on payroll and other eligible costs over an eight-week period. However, the first round of PPP funding quickly ran out, and then we saw headlines about Fortune 500 companies receiving funding while many small businesses in desperate need did not. In response, during the second round of PPP funding the SBA issued a statement that only businesses who are in need of financial assistance were entitled to PPP funding and issued safe harbor rules to allow for the return of funds without penalty. This announcement is creating uncertainty for small businesses as to whether they were eligible for funding to begin with, and if they will obtain the forgiveness. We feel the vast majority of small businesses, especially in the postsecondary education sector, legitimately received the funding and have nothing to worry about.

The American Institute of Certified Public Accountants (AICPA) issued this announcement on May 5, 2020, that discusses this uncertainty, which personally we feel was very important: https://blog.aicpa.org/2020/05/small-businesses-should-focus-on-ppps-intent-keep-using-funds.html#sthash.InvjtTud.dpbsights?utm_source=mnl:cpald&utm_medium=email&utm_campaign=06May2020

While we wait for specific guidance from the SBA on how the loan forgiveness will be computed and determined, let’s review the underlying accounting treatment of the PPP loan. The basic accounting entries are as follows:

PPP Loan Received

Debit – Cash new PPP account or cash operating account

Credit – PPP loan liability

PPP Loan Forgiven

Debit – PPP loan

Credit – Debt forgiveness income

The key issues are the amount of loan forgiveness an institution will receive and the timing of this forgiveness. Our understanding is that the lender has 60 days to review and submit the request to the SBA, and then the SBA has 30 days to make their decision. Based upon when the PPP loan was received, many institutions will be ending their eight-week period some time in mid- to late June, possibly July if the PPP loan was received in the phase 2 funding. Assuming a two-week time frame to gather documents and submit the forgiveness request, we would infer that it will be September, at the earliest, before any loan forgiveness will begin to occur.

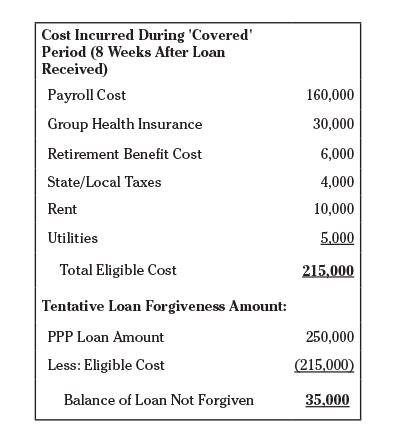

Below is an example of the calculation to determine the loan forgiveness:

It’s important to remember that while filling out the application companies didn’t have a choice on how much the PPP loan was for, so we expect that a lot of companies won’t get the entire loan amount forgiven — and that’s ok. Any amount not forgiven remains a loan with very favorable terms to be repaid over a two-year period at 1% interest. Amounts that are not forgiven do not have any restrictions on how they are spent.

From our initial research, it appears that the loan forgiveness falls under Accounting Standards Codification 470-50, which relates to Debt Modifications and Extinguishments. This guidance indicates that the recognition as Gain on Extinguishment of Debt (loan forgiveness) would not be made until the company is legally released from the obligation. We have not seen any guidance that would indicate this gain could be recognized as of a company’s year-end based on this occurring as a subsequent event. Thus, for institutions which are a June 30, 2020 year end, none of the PPP loan forgiveness will be reflected as income and it may be unlikely this will occur for any institution with a July, August or September 2020 year end as well. We are monitoring the discussions of the FASB as this program impacts a wide range of companies, and specific guidance may be released pertaining to the underlying accounting.

Composite score impact

Certainly, all of this accounting lingo has been a riveting read, but the ultimate question many institutions want answered is, “How do these relief funds impact my composite score ratio?” Institutions should consider these items in advance of their yearend, especially if the yearend is not December 31. We are thinking that by December 31, most of the funds will have been expended, reimbursements claimed, and hopefully, the PPP loan forgiveness received. Thus, an institution with a December 31 yearend will be receiving the full benefit of this relief funding.

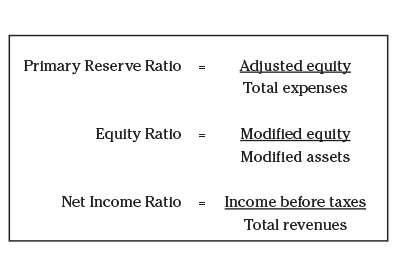

Quick reminder that the composite score ratio (CSR) has three components:

HEERF student grants

Overall the impact should be fairly minimal. Any amounts drawn down and not expended increases cash, which increases total assets, so the denominator in the Equity Ratio is increased. Therefore, this reduces the score so, as we recommended above, don’t draw down funds from G5 until the student HEERF is disbursed.

If the student HEERF has to be reflected on the income statement as grant revenue and a student expense, this has some detrimental impact on the Primary Reserve Ratio and the Net Income Ratio as the denominators in each of these ratios are increased. Therefore, institutions should model their CSR and include the anticipated amounts of the student HEERF to be expended in advance of year end. This is probably only impactful if the overall CSR is in the 1.5 to 1.8 range.

HEERF institutional grants

Similar to the student HEERF amount, don’t draw down any funds until a qualified expenditure has been made, as the institution would be unnecessarily increasing cash and total assets, which lowers the Equity Ratio. For expenditures, which are made prior to year-end and the institution believes can be reimbursed using the institutional HEERF amount, draw down these funds and recognize grant revenue prior to yearend. This will make the net income impact of this expenditure zero, as the grant revenue will be recognized for the same amount as the expense. If the item is a capital asset in nature (i.e., new server), the institution should continue to monitor the published guidance, as the grant revenue may need to be spread over the life of this capital asset similar to how the depreciation expense is being recognized. In addition, no long-term debt will exist to offset this amount of fixed assets in the Primary Reserve Ratio.

PPP loan forgiveness

This item may create the biggest disconnect between the recognition of the income and the expenses. The expenses related to the PPP need to be recognized as they incur during the months of April to July (depending on the timing of each institution’s PPP loan). However, as we discussed, it is unlikely any forgiveness will occur until late third quarter or the fourth quarter of 2020. Thus, the CSR benefit for many institutions might not occur until their next fiscal year. Until any loan forgiveness is received, the PPP loan is long-term debt (due in two years) and this loan will not count as long-term debt in the CSR under the new Borrower Defense to Repayment (BDTR) regulations. For audits submitted to ED after June 30, 2020, long-term debt must be post-implementation qualified long-term debt to be treated as an add-back to fixed assets in the Primary Reserve Ratio. For long-term debt to be deemed qualified, it must be directly related to the acquisition of fixed assets and clearly a PPP loan does not meet this requirement. (See the October 2019 issue of Career Education Review for a more in-depth discussion of the new BDTR regulations and the changes related to the treatment of long-term debt in the CSR).

As the related expenses are incurred, we envision institutions compiling an “expense report” to support the PPP loan received.

This expense report would document the various expenses covered by the PPP loan (salaries, rent, utilities). Our recommendation would be to prepare this expense report whenever the expenses occur (bi-weekly for salaries, monthly for rent, utilities and health insurance). As we await guidance on the loan forgiveness, remember that the eight-week period starts from the day the PPP loan was received. Thus, a “clean” cutoff with your payroll cycle and monthly expenses is unlikely to occur. This could result in having to prorate costs at the beginning and end of the eight-week period to ensure the expenses align exactly with this period of time. It is also very important to be tracking your full-time equivalents, as a reduction in the loan forgiveness will occur if these are not restored by June 30. We recommend institutions contact their auditor, review the AICPA website, or reach out to us for assistance in developing a spreadsheet.

When the forgiveness is received, this will be recognized as debt forgiveness income in the financial statements. The increase in net income will benefit all three ratios, as net income and equity (all three numerators) will be higher. Total revenue in the denominator of the Net Income Ratio will be higher, as well, but this impact should be significantly outweighed by the positive impact in all three numerators.

We have covered a lot of information in various areas for an institution to consider. To conclude, institutions should be taking these steps:

- Ensure the accounting for the HEERF and PPP amounts are not commingled in bank accounts and your general ledger. Track funds in new accounts to provide a clear trail for the stewardship of the funds.

- Maintain well-structured policies, procedures, documentation, and internal controls to support any funds disbursed.

- Project your composite score ratio in advance of year end and ensure you have factored in the impact of this relief funding. This is especially critical for the June 30 to September 30 fiscal yearend institutions that may still be reviewing how the institutional HEERF funding can be utilized and for which the PPP loan forgiveness is unlikely to be recognized.

Finally, continue to monitor guidance being issued related to the accounting and recognition of this relief funding. Due to the rapid manner in which these funds have been released, the FASB, various industry associations and CPA firms have been working to provide the appropriate guidance. Continue to check our COVID-19 updates on our website for updates on the specifics related to the HEERF and PPP loan financial reporting recognition as more information is released. In the interim, focus on running your institution, talk to your attorneys and CPA for guidance to limit your research time, and double check your policies, procedures and documentation. Rely on your trusted financial advisors to help you through this crisis. Stay safe and stay sane.

MICHAEL WHERRY is a Certified Public Accountant who has 25 years of experience providing a full range of client service and consulting services in the public sector to postsecondary schools which include financial statement audits, Title IV compliance audits, agreed-upon-procedure attestation engagements for regulatory requirements, 90/10 calculation reviews, composite score projections and planning, financial statement reporting, consulting and understanding of new accounting requirements, transaction services for buyer/sellers, internal control processes and procedures, and coordination with the Tax Department on tax savings and opportunities. He has presented at regional and national industry conferences in regard to regulatory and audit issues affecting postsecondary institutions.

Prior to joining McClintock & Associates in 1991, Mr. Wherry worked for Deloitte. In addition to his professional responsibilities, Mr. Wherry is the treasurer of the East Liberty Family Health Care Center in the city of Pittsburgh and has earned the honor of Eagle Scout. He resides in Pittsburgh, Pa. with his wife and two sons.

Contact Information: Michael Wherry, Director // CPA // McClintock & Associates // mwherry@mcclintockcpa.com // https://www.linkedin.com/in/mikewherry/

David McClintock is a Certified Public Accountant who joined McClintock & Associates in 2003 and has been focusing on serving postsecondary institutions since that time. In addition to leading financial statement and Title IV compliance audits, clients appreciate Dave’s advice and guidance related to their 90/10 calculation, composite score projections and when considering acquisitions in the industry and he has shared this advice as a presenter at a variety of industry conferences. He succeeded his father, Bruce, as Managing Director of the firm and continues to appreciate the reputation and respect people have of his father.

Dave’s family has been supporters of the Leukemia and Lymphoma Society holding an annual fundraiser that has raised over $550,000 since 2006. In addition, Dave enjoys traveling to new places with his wife and their two children and has spent years coaching youth sports in baseball, basketball, soccer and hockey.

Contact Information: Dave McClintock // CPA, Managing Director // McClintock & Associates // dmcclintock@mcclintockcpa.com // https://www.linkedin.com/in/davemcclintock/