Converting the Worst of Times into the Best of Times: Market Research in a Time of Rebirth

By Aaron Edwards, Founder, Edwards Strategies and Dr. Joel English, Vice President for Operations, Centura College, Aviation Institute of Maintenance, and Tidewater Tech

Introduction

As career school operators, we know that the last two years have featured a cultural phenomenon where politicians, higher education administrators, and society, in general, have rediscovered the value of skilled trades and the educational pathways that prepare people for well-paid jobs in technical areas. We have collectively admitted that we pay about the same hourly rate for a plumber or electrician to make a house call as we pay our dentists and physicians, and even the final hold-outs – public high school guidance counselors – are admitting that career training is not only a viable educational path after grade 12, but it is a more probable route to gainful employment than a four-year degree. If we can simply be great at what we naturally do, we should have a strong future.

However, if you’re reading this article in Career Education Review right now, you might correctly be called “lucky.” We know that the last seven years in higher education (all sectors of higher education, make no mistake) have featured declined enrollments and shuttered institutions.

In July 2017, Inside Higher Ed reported that the number of Title IV-eligible institutions decreased nearly 10 percent from 2013-2016, which doesn’t even include the closures of the Brightwoods, Corinthians, ITTs, Souths, Virginia Colleges, and Vatterotts that shut down in 2017 and 2018.

On Jan. 29, 2019, Education Dive recapped all 172 school groups that closed between 2016-2018 (not 172 campuses, 172 groups of campuses), and that list features private and public institutions; career schools, community colleges, and universities. It’s been a tough go.

That said, within a culture that has freshly agreed that what we need most from higher education is career-based programming that prepares graduates for skilled trades, we believe we stand to win more than we lose, if we are willing to look objectively and critically at the programs we offer within the communities in which we offer them. Our challenge is to intensely evaluate the programs that we teach, the campuses we administer, and the communities in which those campuses are situated to assure that we are teaching the right things, in the right marketplaces, at the right time. Schools that are not teaching the right thing in the right place and time will appear on Education Dive’s next update of closed institutions. Schools that are teaching the right things at the right place and time will likely not only survive but thrive. This article gives the example of how Centura College, based in Virginia Beach, Virginia, has been critically analyzing its offerings within its campuses, and how it has employed Edwards Strategies to conduct the market research that has led to key strategic decisions.

Researching troubled campuses

Back in 2012, Centura College consisted of 11 campuses which were spread from Washington, D.C. to Orlando. Centura College thrived when everyone thrived. And no surprise, Centura’s population waned along with the trends over the past seven years. Centura College quietly taught out programs and consolidated a few campuses over the past seven years (always making sure to teach every student through the end of their programs, always offering career services to every graduate, never leaving a single student without a school from which to graduate). By 2017, Centura seemed to have the right mix of strong campuses and programs in Southeast Virginia, but two campuses – one in Richmond, Virginia and another in Columbia, South Carolina – continued to struggle. The institution’s tried and true programs in Medical Assisting and Medical Billing and Coding stopped drawing the attention needed to amass the student body needed to sustain those campuses, and they feared that closing Richmond and Columbia may have been necessary.

But before taking a teach-out action, Centura College fielded a call from Aaron Edwards’ marketing and consulting group, Edwards Strategies. The question to Edwards Strategies was: What should Centura be looking at to determine whether they were teaching the right types of programs, given the communities they were serving, and given the competing institutions around those cities? The campuses in Richmond and Columbia perpetually struggled in student population, and they were losing ground rather than gaining financial viability. Over the following months, Edwards and his team engaged in multiple layers of market research, population analysis, employer and job outlooks for the types of programs Centura College served, and the competitive set within the metro areas in which these two schools were housed. The next section provides a detailed view of the research process and how the research team did their work. But first, let’s take a look at the decisions Centura College made, based on the results of this study.

Good news for Richmond. The Edwards Strategies Report quickly showed that the Richmond, Virginia metro area, when compared to the types of schools that currently had campuses there, supported reinvesting in that campus. The population of Richmond proper was 223,170, and only about a third of that population already had a post-secondary diploma. The population had grown 9.3 percent since 2010 and was still in a growth pattern, and the suburbs of the city (such as the southern borough of North Chesterfield, where the campus resides) continued to grow. Importantly, there were only six significant competitors within the city offering programs like those that Centura offered, and there was no community college nearby offering programs like theirs. (Since the report concluded, three of the six competitors closed along with their large school group parent companies.) And Edwards Strategies found a wide range of medical groups and hospitals, as well as construction and trades companies, who craved hiring certified graduates of programs like Centura’s. Though the current mix of programs were exclusively in Allied Health (Medical Assisting, Dental Assisting, Massage Therapy, and Practical Nursing), the Report noted a thriving construction and maintenance community that desperately needed certified professionals in building maintenance, welding, HVAC, and elevator repair.

The Edwards Strategies Report spelled a reasonable future for our Richmond campus if Centura was willing to re-invent themselves by adding new programs and potentially sunsetting a few underperformers.

And that’s exactly what Centura College did. Throughout 2018, Richmond taught out two under-performing Allied Health programs, but more importantly, they added Skilled Trades programs. By adding Combination Welding, HVAC, Construction Electrician, and Building Maintenance to our Richmond campus, Centura built a more balanced and robust offering of Trades programs to add to their healthy Allied Health programs. Centura wasn’t just throwing trendy programs together; rather, they chose programs that were tailor-made for the employers seeking work in local industry, to assure that the programs are not only compelling to inquiring enrollees, but also directly focused on the employers who need to hire their graduates. Indeed, Richmond did appear to be the right place for a campus, as long as they were able to adapt program offerings to teach the right things. Today, the Richmond population is growing, and Centura feels confident that this school will be a winner.

Not such good news for Columbia, though. The Edwards Strategies Report showed a contrasting picture down south, where the population of Columbia was only 130,192 and was only growing at a 3.2 percent rate since 2010. Nearly half of that population already possessed a post-secondary degree. Though Columbia was a rather industrial city and featured an aging population (suggesting possibility with Trades and Allied Health programming), the Report observed that there were 11 competitors currently teaching similar programs. One of those competitors was the public institution named Midlands Tech, which offered all of Centura’s programs at the attractive pricing structure that being part of the state community college system allowed. Midlands Tech enjoyed a student population of around 11,000, and their marketing budget put Centura’s to shame. It was certainly not the role of Edwards Strategies to tell Centura to close its Columbia campus, but their objective research provided the information Centura needed to determine that it would be unlikely to be able to thrive within that market, against that competition, with the programs that they were likely to offer. And so, in June 2018, Centura College made the determination to cease enrolling new students in that market. They are teaching all of their students through the end of their programs, and they are providing dutiful career services to all graduates as they conclude their education. But later in 2019, when Centura has taught out all students and served all of their graduates, they will discontinue operations in Columbia.

What was essential for Centura College was sound, objective research with which they could make decisions about struggling campuses. Of course, the faculty and staff at the Columbia campus would have loved to teach their students within their existing program mix indefinitely. Campus staff and faculty are naturally student-centered and love working with students, which is wonderful. But the closer an educator is to a school and a community, the less likely they are to be able to think objectively about what changes might be needed to remain viable. No surprise, no Columbia-based Billing and Coding instructor ever suggested that the school might want to close the Billing and Coding program because of competition, nor did a Columbia administrator ever suggest that the Columbia community might be too oversaturated with competition to keep the school growing. Few of us naturally make observations that would ultimately result in our own unemployment – at least we don’t say it out loud. Similarly, no Richmond-based Medical Assisting instructor ever said, “You know what would make this school great? A Welding program.”

Again, the closer we are to what we’ve always been, the less likely we are to suggesting revolutionary ideas that may upset our own apple carts. Status quo and rebirth are natural enemies.

In order to reimagine, Centura College needed an objective perspective and a third-party investigation of the markets, the job opportunities, and the competition. Once Centura had the courage to look at what was being presented, they were amazed at how brave they could be to follow the natural and logical pathway (to teach out one campus and refresh the programming at the other). Let’s take a look at how Edwards Strategies structured their research project.

The Edwards Strategies process

The Edwards Strategies process started with the understanding that the project was large, potentially disruptive, may not make friends at the campus level. The Edwards team considered four main areas of inquiry for the project:

- Analyze the segmentation and demographics of students with whom the campuses had historically been successful

- Determine potential opportunities to improve enrollment at the Richmond and Columbia campuses

- Assess the markets of each city and surrounding areas

- Assess program viability of current and potential programs given the area’s workforce opportunities

The approach for each section required dozens of data points and unique considerations. Edwards Strategies outlined several items that they would need from Centura College in order to effectively analyze each component of the project. A significant element to even starting this was ensuring the data was accessible and clean in order to build a solid foundation.

The starting place was to analyze the student segmentation of Centura’s students over a historical perspective. This inquiry examined the demographics of Centura’s students on a program-by-program basis. Oftentimes, the data doesn’t necessarily align with institutional perceptions; indeed, institutions sometimes don’t understand or admit to themselves who their student body is and isn’t, and where their growth potential may lie. Within this phase of the research, Edwards Strategies reviewed active and prospective student demographic information at multiple levels. Ultimately, we wanted to see what the Centura student population makeup was: age, gender, ethnicity, program mix, degree type, day and night shift, inquiry mix, location, etc. This research phase also investigated the students’ geographical location within the cities, allowing us to determine the current penetration of the Centura College name within the areas, how much competitive weight Centura seemed to carry socially, and the recruitment potential within those areas going forward. This thread of research would provide a clear statement about potential student population growth, with which Centura College would be able to create a strategy to realize that growth later. Understanding who Centura was currently serving was a paramount first step.

Second, the research project compared active students to the prospective students Centura was recruiting at the campuses, both at the lead source level and at the program level. This inquiry allowed us to compare the overall student population to the market itself and compare the student population to the inquiry mix, so as to evaluate recruitment opportunities. Additionally, we evaluated the distance of students to the campuses and to competition, in order to determine the impact that driving distance made on enrollment and to ultimately refine recruitment pockets. Edwards Strategies was quite aware that schools like Centura College rarely ask the difficult questions about whether their campuses are located in the right place within a city, if for no other reason, because the cost and headache of moving locations would be too great. The location question is rarely a question for which schools want to hear the answers. But the Edwards Strategies process asks those hard questions, because each factor impacting institutional success is critical. These questions allowed us to ensure that marketing strategies would line up with the current student population, and it would allow the institution to evaluate specific programs and put weight onto programs that would be more likely to succeed within the area of town and neighborhood in which the campus resides.

Third, Edwards Strategies conducted a full market assessment of the cities and surrounding areas in which the campuses resided.

Obviously, understanding the dynamics in the markets themselves was critical for establishing primary recommendations within the report back to the institution. Inquiry points for the project evaluated both the competition of other institutions within the geographical area, and a review of the employment market itself. The Edwards team studied the historical footprint of competitors, an evaluation of the competitor’s advertising spend as compared to Centura’s, messaging approaches, proximity to the Centura campuses, number and level of programs offered, and a comparison of tuition rates. Within the employment market research, the team studied population trends, 10-year employment projections by field, education trends of citizens, income levels, and market demographics. The extensive report that followed this research allowed Centura College to evaluate key performance potential within both of the markets being studied:

- How competitive is the market overall?

- How is Centura College positioned against competitors and how can it become better positioned?

- Is Centura’s marketing investment ensuring enough market share?

- Are the market demographics favorable for our student population and do they project favorably in the future?

- Are there jobs today and will there be jobs tomorrow in the fields that Centura is likely to teach?

- What programs are most aligned with the workforce development opportunities most common to the markets being studied?

The fourth and final movement of the research project inspected a full range of workforce development needs within the study markets. In its simplest form, the Edwards Strategy project would help identify which programs Centura should continue to focus on, which they should consider teaching out, and what potential programs might be worth adding down the road. Within this inquiry, Edwards Strategies studied the job demand of various occupations within the regions, evaluating current and future career opportunities within each market. The team compared national trends with these regional trends, evaluating the potential of occupational areas over a 10-year period into the future, and they evaluated the institutional competition, prospective student demand, and job growth in terms of all of these occupational areas. Edwards Strategies also evaluated the earning potential of new professionals within these occupational areas, the potential for employer partnerships (including the names of the top companies with whom Centura should engage), and the top individual skills that these employers needed. Given this full picture of employer needs within the markets, Edwards Strategies was able to recommend new program areas that Centura should consider adding to their program mix.

The Edwards Strategy Quotient (ESQ)

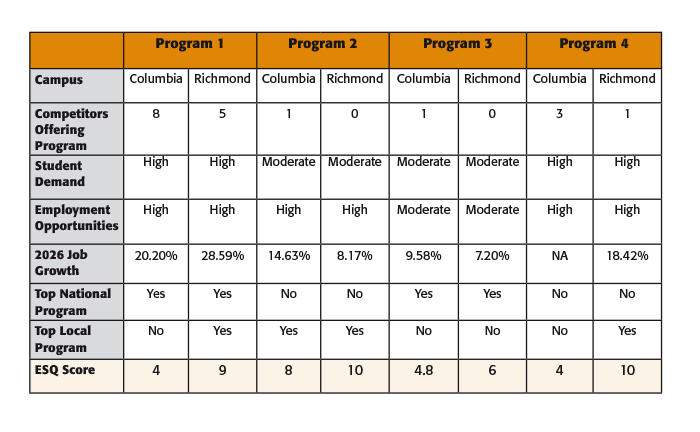

Edwards Strategies layers hundreds of data points into its Edwards Strategy Report in order to provide institutions with a clear and concrete sense of which programs (both current and potential) project most favorably. Combining student segmentation data, market evaluation, and overall program-specific data points provides a global view of program viability, and all details of data are described within the report. But with so much big data rolled into the report, institutions find themselves asking for a simplified, boiled-down version of the research, which will also deliver the program review in a manner that is easily digestible. To provide this snapshot or “dashboard” view of program observations, Edwards Strategies provides an analysis of each program labeled with an Edwards Strategies Quotient (ESQ). The ESQ is a weighted calculation for each program based on market evaluation, local and national competition, employment outlook projections 10 years into the future, job demand, student interest, relationship to current programs, school brand recognition, and new program positioning over the short and long term.

While school administrators and academic affairs departments certainly want to be presented with the vast array of data points and results found within the Edwards Strategy Report, it is common for top executives of the institution to flip directly to the ESQ to see how individual programs score within this quick-view of the program outlook and market research. This is how the ESQ Program Landscape chart presents within the Report:

Program Landscape

Within the Program Landscape chart, any reader of the Report can quickly see how the programs being offered (and being recommended) for a particular campus rank within the market factors being researched. Within the Centura College project, Edwards Strategies compared each program side-by-side between campuses, in order to show how the programs and campuses compared to each other. When Centura administrators viewed the Edwards Strategies Report, they immediately saw that all of the programs yielded a lower ESQ in Columbia than in Richmond. They could then begin to drill down on why Program 1 seemed to project so favorably in one market over the other, or why Program 3 didn’t seem to be highly viable in either market, or ultimately, why Columbia seemed to be such a weak market altogether in comparison to Richmond. Though the Edwards Strategies process and the report it produced provided detailed explanations of hundreds of data points, nothing was more immediately-telling to the Centura College team than the quick-view of program viability presented on the ESQ Program Landscape.

Centura College of Allied Health and Trades

After Centura College concluded its research project with Edwards Strategies and made the changes to its Richmond and Columbia campuses, the campus directors at Centura’s other thriving campuses in Southeast Virginia wanted a piece of the action. Centura College administration challenges campuses to innovate programming that will be impactful within the local communities, and seeing the impact of the Edwards Strategies Report, other Centura Campus Directors requested a similar research project for all of the communities they served. In mid-2018, Centura College rehired the Edwards team to conduct that project, and again, they gained beneficial information. The report conducted for these remaining four campuses guided Centura to teach out most Business, Legal, and other para-professional programs at its Virginia campuses and to focus on Allied Health and Skilled Trades, much like the programming mix refined in Richmond.

Indeed, the institutional introspection that followed this second report led to a powerful (even if slight) branding decision: Today, when you see a Centura College ad or website, you’ll see that the Centura College logo has been treated with the call-sign, “Allied Health and Trades.”

That new “Allied Health and Trades” moniker may or may not attract any more students, and it may or may not mean much to anyone outside of Centura College. But at least internally, it has helped the institution clarify for itself who they are, what their programmatic strategy is, and how they believe they will be successful within the coming decade. Edwards Strategies never suggested anything to Centura about its logo, but the objective research that they conducted led the institution into a level of introspection and strategy that resulted in a declaration of identity, and branding around that identity. The future of institutional success relies upon our ability to teach the right things in the right communities at the right time. And for Centura College, the key to unlocking that future has been rooted in the objective research and analysis within this project.

That new “Allied Health and Trades” moniker may or may not attract any more students, and it may or may not mean much to anyone outside of Centura College. But at least internally, it has helped the institution clarify for itself who they are, what their programmatic strategy is, and how they believe they will be successful within the coming decade. Edwards Strategies never suggested anything to Centura about its logo, but the objective research that they conducted led the institution into a level of introspection and strategy that resulted in a declaration of identity, and branding around that identity. The future of institutional success relies upon our ability to teach the right things in the right communities at the right time. And for Centura College, the key to unlocking that future has been rooted in the objective research and analysis within this project.

AARON EDWARDS is the Founder of Edwards Strategies, a higher education company focused on enrollment solutions. Aaron has over 14 years of experience developing high-impact enrollment strategies in marketing, admissions and research. Mr. Edwards has managed multiple aspects of education marketing and student life cycle innovation. His drive and focus for developing and implementing solutions has positioned his clients for long-term, sustainable success. During his career he has served on boards, committees and counsels dedicated to enhancing the value and direction of higher education.

Contact Information: Aaron Edwards // Founder // Edwards Strategies // 785-550-0610 // aarone@edwardsstrategies.com // edwardsstrategies.com

DR. JOEL ENGLISH is the Vice President for Operations of Centura College, Aviation Institute of Maintenance, and Tidewater Tech, where he supervises all operations over the 18 campuses across the country. Dr. English served as a Commissioner for the Accrediting Commission of Career Schools and Colleges (ACCSC) for six years, serving as the Chair for two years, as well as chairing the Distance Education Committee. In previous positions, Dr. English served as the CEO for the Ohio Centers for Broadcasting, Illinois Centers for Broadcasting, and Miami Media School, a family of schools dedicated to technical education in radio, television, and internet media broadcasting. He also oversaw distance learning and school operations at several campuses as a Regional Director and Executive Director at Centura College, and he was formerly an Assistant Professor of English and Distance Learning at Old Dominion University. Dr. English published Plugged In: Succeeding as an Online Learner through Wadsworth/Cengage Learning, as an extension of his dedication to supporting student success within online courses and programs. Dr. English holds a Ph.D. in Rhetoric and Composition from Ball State University, and an M.A. and B.A. in Technical and Expository Writing from the University of Arkansas at Little Rock.

Contact Information: Dr. Joel A. English // Vice President of Operations // Centura College, Aviation Institute of Maintenance, Tidewater Tech // 757-456-5065// jenglish@centura.edu

Comment(1)