The Best Process to Plan and Control Your Audited Financial Statements

By Stephen B. Friedheim II, President, Friedheim Advisory Services, Inc.

Every year your accounting personnel prepares information for your CPA, who examines and tests the information, usually prepares your financial statements and, after what sometimes feels like an exorbitant period of time and an outrageous fee, provides you with an audited financial statement. Too many CPA’s take your financial data, make adjustments to the data as the CPA deems necessary, and present you with an audited financial statement (and a bill) that may surprise you.

The solution to eliminate these surprises is relatively easy. Basically, the solution requires that you take control of the audit process by becoming better informed.

Planning the entire audit at the beginning will go a long way toward reducing the pain, time and cost associated with an audit.

The first step is to understand the audit process. Simply put, the audit process requires that an auditor perform enough examinations and tests to render an opinion that your financial statements are presented fairly. Auditors must comply with Generally Accepted Auditing Standards (GAAS) and Generally Accepted Accounting Principles (GAAP). GAAS defines the methods to be used by an auditor in examining and testing your records. GAAP defines the manner that accounting information must be recorded and presented.

Auditors do not take responsibility for your financial statements. They simply render an independent, objective opinion as to whether or not the financial statements are presented fairly. Auditors can assist in the preparation of financial statements. However, as expressed in the client representation letter and prominently in the audit opinion “the financial statements are the responsibility of management.”

As GAAS defines the method to be used to examine your records, it will be the area in which you want to focus to ensure a more efficient and effective audit by your CPA. One of the fundamental principles in GAAS requires an auditor to plan the audit by designing an Audit Program. This program documents the steps and procedures that the auditor expects to take to form an opinion. Armed with an idea of the work required, an auditor can estimate the time necessary to complete each step. This time estimate in total hours is the Audit Budget.

Audit budget and fee estimate

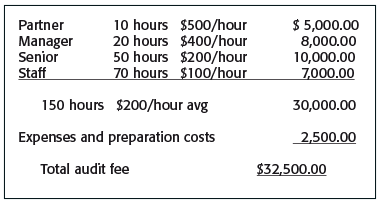

The next phase is to identify the level of skill required to complete each step of the audit program. The allocation of skill levels will determine the personnel requirements, which when multiplied by the charge per hour determines the standard audit fee. For example, let’s assume that your audit budget estimates that 150 hours of total audit time are required. The breakdown might be as follows:

If you know this information before the audit even starts you can control the timing and cost. Let’s say that you work with the CPA to plan the work and find out that the Staff time of 70 hours is primarily preparing workpapers and pulling files. If your staff does not have the time, you could work with your CPA to hire a temporary accountant at $30.00 per hour. This would reduce the staff time by 25 hours and save $1,750.00 (25 hours x $70.00 per hour savings). You could also find out that 20 hours of the Senior’s time is to be spent doing tasks that could be done for them. If your accounting temporary did the work, you could save an additional $3,400.00 (20 hours x $170.00 per hour savings).

Often CPA firms have personnel who are between assignments that need to be kept chargeable generating income for the CPA firm. Your CPA may be able to “sell” you an accounting temporary for a substantially reduced rate per hour. In addition to reducing your audit fee, you will also help your CPA and remove the time associated with training a temp.

In this example, you have just saved $5,150.00 or 19 percent of the proposed audit fee by better planning the audit process. If your staff has the time to do the work you would save an additional $1,350.00. Obviously, if you want to plan your audit effectively you must obtain the following prior to the audit beginning:

- An audit budget

- A fee proposal

- The audit program

- List of schedules to be prepared by you or PBC’s (Prepared By Client)

- Scheduling of the audit work

If you have both a fee proposal and an audit budget, you can compare the total fees to an average rate per hour. I have seen CPA’s bill their clients $10,000 more than an original fee proposal of $20,000 for an audit. When asked the reason the response is almost always “The additional fee is necessary due to increases in the amount of time it took to finish the audit.”

Many people will accept at face value that if it took longer, it must be worth more. However, when you ask the CPA “Exactly how much more time was required?” you might hear that an additional 20 hours was required. It does not take a genius to figure out that the extra bill is for an average of $500 per hour! Unless the full 20 hours of that work was performed by a partner of a Big Four accounting firm, you may be paying too much.

Remember, when you get an audit budget and fee estimate at the beginning, you will know the average cost per hour for your audit. You also can control any cost overruns, should they occur (as they almost always seem to do). If a CPA commits to a fee of $20,000 and estimates that the amount of time required is 125 hours, you know that the average rate per hour is $160.00. Then, if the audit takes an additional 20 hours, all things being equal you should be able to expect an increase of approximately $3,200.

You should note that it is a requirement that the prior year’s audit fee MUST be paid before the current year’s audit can begin. This is a requirement and not just a CPA’s request. The AICPA Professional Ethics Committee requires prior year fees to be paid or the CPA will not be considered independent and will therefore not be able to render an opinion. It is an ethics violation for a CPA to begin audit work with outstanding fees from the prior audit.

Audit program

Obtaining an audit budget also allows you to see how the CPA expects to allocate their time. You may be able to identify areas in which you can reduce the auditor time by improving on inefficient or ineffective audit techniques. For example, one of the single largest assets for a school is the student accounts receivable. Generally Accepted Auditing Standards (GAAS) require that accounts receivable be confirmed to reduce the risk of overstatement of the accounts receivable. A third-party confirmation is considered very reliable, as it is unlikely that someone would confirm owing an amount greater than the true balance.

Unfortunately, CPA’s are used to dealing with manufacturers and retailers, who sell their products to a customer that takes the products and leaves. Consequently, the CPA must send the customer a letter (that you prepare). When the customer does not respond, a second request must be sent. If the customer still does not respond the CPA must verify the balance using “alternative procedures” which include verifying cash receipts, examining contracts, etc.

However, in a school the customer is your student.

When you send your students a letter asking them to confirm the amount of money they owe, most of them become confused and think you are trying to force them to pay early.

Consequently, many students will not confirm anything, forcing the CPA to perform alternative procedures. Further, your students are sent letters when they are located somewhere on your campus.

Don’t waste your personnel’s time preparing letters. Don’t create conflicts trying to explain to the students that the letters are not a demand that the student pay in full. Above all don’t let your CPA spend your money tracking letters sent, returned, results of differences, and pulling all the files for students that do not respond.

Instead, have your CPA send their least expensive person to come out at or near the end of the year. This person can have the students review their ledger cards or statements before class. If the CPA then gets the students to sign the ledger card or statements signifying that they agree with the information, your CPA will have confirmations from a majority of your active students or whatever sample they select. Using this technique, you can cut the audit time for active student accounts receivable to four hours per campus. If the CPA expected to spend 40 hours on this procedure, you would have saved 36 hours of time and the related fee.

You should review all aspects of the audit program to ensure that the audit program is written with your school in mind. Some audit programs are nothing more than duplications from some other client that may or may not be in the proprietary school industry. The audit program should identify the work to be performed and the workpapers required for such work. This knowledge will help you better prepare for your audit.

PBC’s

PBC’s or Prepared By Client workpapers should be defined prior to the beginning of an audit. If you know all the information that the CPA needs, you can prepare (or have a temporary accounting person prepare) all workpapers and schedules for the CPA before the work begins. The audit program identifies (or should identify) all the required schedules. If you prepare the schedules, instead of the CPA you will save the CPA time and consequently your money.

Get a list of all PBC’s required, then identify a due date. Check off your list as you deliver. Always prepare the schedules in the CPA’s format (or a format agreed to in advance) to ensure that the CPA will not have to learn your format. Using a prescribed format increases the audit efficiency.

Where schedules detail items such as property and equipment, go ahead and copy invoices for the more significant items. Attach the invoices behind the schedule. If you prepare a schedule and attach all the support to the schedule, the audit time is reduced to minutes instead of hours. The more you do, the less the CPA must do, and the less your fees will be.

Scheduling and deadlines

Have you ever noticed that your financial statements and tax returns are frequently issued at the very last minute? There always seems to be a constant surge of activity as a filing deadline grows near. As the deadline approaches you find that you wake up screaming in the middle of the night.

You call your CPA and get a commitment that the work will be done in time. The CPA says, “Don’t worry, if I have to work all night I’ll have your financial (or tax return) done.” Then the deadline comes, and you still don’t have your financial statement (or tax return). Although a tax return can be extended, frequently an extension on your financial statements is not available. Instead, you are forced to accept and file a hastily prepared audit report which may include errors.

If you want to improve the completion of your audit, you should establish a financial statement deadline that is earlier than your true filing deadline.

For example, never tell your CPA that your financial statements are due in the accrediting commission’s offices on March 31 (if this is the real due date). Instead, tell the CPA that the financial statements must be in the accrediting commission’s hands no later than Feb. 28. Using this technique, you may get your financial statement by March 15.

The date you receive your report is frequently going to be at or after your deadline. However, if you establish an artificially early deadline, you improve the chances that your audit will be completed in time for your review before it must be sent off to a third party. The extra time will allow you to guarantee that the financial statements professionally present your operations.

You should also schedule the audit so that the audit team arrives after you have completed all the PBC’s. Completing all the PBC’s in advance will give the audit team the ability to hit the ground running. This will eliminate any of the inefficient time at the beginning of an audit discussing when information will become available. It will also avoid the decrease in efficiency caused by waiting for information.

Before the CPA’s arrive, you should have completed and, where necessary, corrected a minimum of the following:

- Have copies of all new agreements, leases, contracts, long-term commitments, and any other significant documents for the year under audit and period through the date of fieldwork. Include all Minutes of any Meetings and any regulatory body communications.

- Have any property and equipment schedules completed together with copies of supporting documentation for any significant acquisitions or disposals.

- Prepare an income statement analysis that compares this year’s results with last year’s. Explain any significant variations.

- Reconcile and provide a copy of the reconciliation and any adjustments for all significant bank, accounts receivable, inventory, accounts payable and other liability accounts. Leaving the reconciliation to your CPA will cost you.

- Reconcile and explain all changes to the equity accounts. Under normal circumstances, the only changes are net income and any distributions. Any other changes should be explained and documented.

- Get a list of all legal fees and explain unusual fees. Provide documentation backup for any unusual or significant fees.

When an auditor waits for information, they are wasting their time and your money. You must control the flow of information so that auditors are kept constantly effective. Never allow your CPA to relax and wait for you. Remember if you have three people on an audit team sitting in your offices waiting on information, you will be paying several hundred dollars for each hour they wait.

Always try to schedule the audit work to be completed in one fell swoop. Eliminate scheduling conflicts that would allow your CPA to come out to your office, perform some work, then leave to come back later.

If your auditor comes, goes and comes back you have substantially reduced their efficiency. Each time you or an auditor put something down and then later pick it up again you incur time to wind down and restart. This extra time should not be necessary. The extra time would not be necessary if you plan the audit schedule to allow the auditor to come out, perform the audit and leave only to have the financial statement printed.

Additionally, by allowing the auditor to leave prior to the completion of all your work you lose control over the audit. Your auditor will leave your offices, go back to their own office and find constant demands upon their time and attention. When your auditor is in your office, you can control their attention and to some degree their time. Make sure that your auditor has done everything prior to leaving your office, except print your financial statement.

Fees and negotiations

When you get your final audit bill is it the same amount that you agreed upon prior to the audit? Did you get a fee estimate before any work was performed? Are you unhappy with your bill? None of these situations should occur.

The only reason you don’t get a fee estimate is because you did not require the estimate. The estimate should be included with the engagement letter.

The only reason that you’re unhappy with your audit fees is that you have not communicated with your CPA during the audit. Remember the more your staff can do the less your audit fee will be. You must control your audit fee in the same way you control your payroll or book costs.

Sometimes you get a fee estimate, and the actual fees are much higher than the estimate. The sole argument for increases in a fee over a fee estimate is that you either did not tell the CPA something that he or she should know, or you did not do something that you agreed to do on the front end. Any other excuse for an increase in fees is unjustified. Put simply if you make the mistake, you should pay for it, but if your CPA makes the mistake, the CPA should pay for it.

For example, the CPA’s staff becomes ill, and the Partner is forced to do all the clerical activities and audit work. Or as another example, the staff person quits in the middle of the audit, and your CPA firm is forced to assign someone new to your audit. These are not your fault, and you should not see an increase in fees because of these unexpected problems. On the other hand, if you neglect to inform the CPA that you have added three campuses to your operations, you should pay for the increase in audit work required.

If you ask your auditor for their rate schedule, you may get a rate per hour breakdown by level of experience. You must remember that these rates are what is known as “standard rates.” Often standard rates mean that this is the rate the CPA would really like to get for their time. In reality, many CPA’s offer a discount off their “standard rate.” If you have not received a discount from the standard rate for your audit fee you should request one. Many CPA’s would be very happy to get at least 80 percent of their standard rate for an audit fee.

Also, you should not have to pay a CPA to “learn” your business. If a CPA does not know the proprietary education business, the CPA should provide you with an additional discount to recognize the automatic inefficiencies that result from becoming schooled in proprietary education. The CPA should be reminded that in the event they get another college as a client (you may even offer to provide referrals) the other client will benefit from the schooling that you provide. If you pay to teach a CPA your business, you are not spending your money wisely.

Financial statement drafts

Often you receive your financial statements at the very last minute. You just have enough time to express mail them to your bank, regulatory body or accrediting commission before a deadline. After the financial statements have been finalized and sent, you get to scrutinize the information.

It is astounding how frequently you will find errors in the financial statements. Some errors may be minor, such as typographical errors, but even these types of errors create an unprofessional appearance. Any misspelled words or improper grammar may cause a lender or regulatory body to question the validity of the financial data.

After all, if you and your CPA don’t care how professional your audit looks, why should anyone looking at the financial statement believe that it was professionally and accurately prepared. Often you get only one chance to present your financial statement. Don’t blow your chance by having a few typographical errors.

The solution to this dilemma is to obtain a financial statement draft prior to completion of the audit.

Often when I performed an audit, I would supply my client with a draft of the financial statements without numbers at the beginning of the audit. This would ensure that my client signed off on known disclosures in advance, thereby eliminating any disputes at the end.

If you request an accounting disclosure checklist, you will get a lengthy form that details most of the types of disclosures required for financial statements. Knowing what must be disclosed, you could even draft your own financial statement footnotes. At the very least, you can require the CPA to draft a footnote for your approval. There is no need to wait until the end of the audit.

Occasionally, some items come to the CPA’s attention during the audit that were not included in your financial statement draft. If these situations occur, you will at a minimum have had the opportunity to review and approve better than 90 percent of the financial statements. Then you only have to focus on any new footnotes.

Your CPA probably has not told you that the financial statements are your presentation of your balance sheet and result of operations. You may present this information in any way that you see fit. Every page of the financial statement belongs to you, except one, the report page.

On the report page, your CPA can agree with your presentation or cite the areas in which the CPA’s opinion on the presentation differs from yours. The CPA may not force you to change your presentation, he or she may only disagree with the presentation and explain such disagreement on the report page. Of course, you do not want your CPA to qualify their opinion, so it is best to work out a mutually agreeable solution.

You should insist on approval of all financial statement adjustments that your CPA proposes before the adjustments are posted. Never allow your CPA to demand adjustments to your financial statements without first understanding why the adjustments are required. Additionally, you should carefully review all disclosures to ensure that the presentation is a positive rather than a negative presentation.

Remember, take control of your audit. Don’t let your audit take control of you.

STEPHEN B. FRIEDHEIM II is a retired CPA and CGMA. Mr. Friedheim is President of Friedheim Advisory Services, Inc., 1547 Wood Lodge, Houston, TX 77077, a financial management consulting firm specializing in proprietary schools since 1985. Services include strategic planning, operational consulting, regulatory considerations, valuation services, bank relations, audit assistance, acquisition negotiations and financing alternatives.

Contact Information:Stephen B. Friedheim II // President // Friedheim Advisory Services, Inc. // 281-589-8628 // s.friedheim@friedheimadvisory.com // FriedheimAdvisory.com